Over the years, I’ve had countless conversations with friends, coworkers, and even family members about money—particularly the money they aren’t investing. Not because they don’t want to grow wealth, but because they feel overwhelmed, unsure where to start, or simply unaware of what they could be doing.

That’s why I’m writing this blog. To help you gain clarity, direction, and ultimately control over your finances so your money works for you.

If you’re in the stage of life where you’re working, earning, beginning to save, or looking to grow your wealth, this guide is for you. It’s a way to think about money not just in terms of returns, but in terms of resiliency, confidence, and freedom—layered in a practical, strategic order.

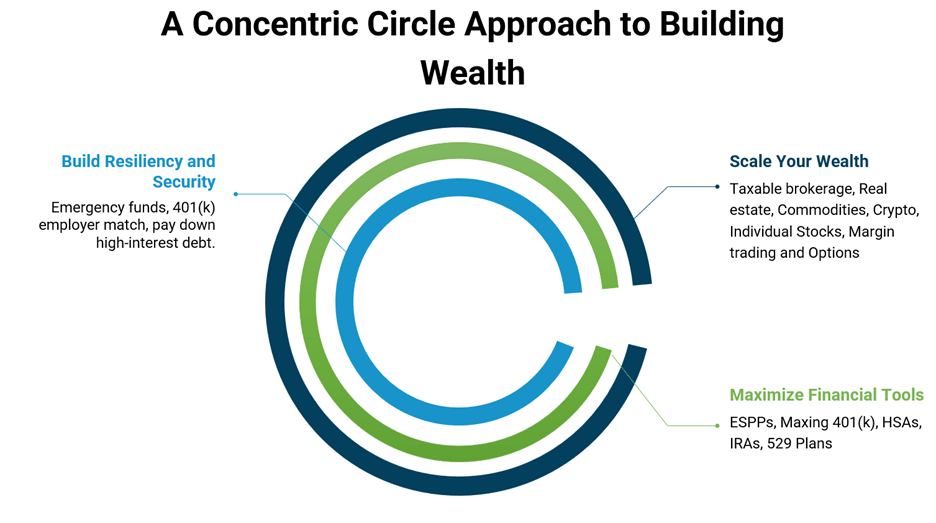

Each circle represents a core outcome you’re working toward. Start at the center, and expand outward as your financial strength grows.

Circle 1: Build Resiliency and Security

This inner circle is about protection. It’s the foundation of your financial life—ensuring your current and future selves have the basic safety and liquidity needed to weather life’s surprises.

1. Emergency Fund (3–6 Months of Expenses)

Before anything else, make sure you have a cash cushion. Life happens – this keeps you from going into debt when emergencies hit. You’ll sleep better at night knowing you can handle a job loss, medical bill, or car repair.

How to build it:

- Aim for 3–6 months of core expenses (rent, food, insurance, etc.).

- Put it somewhere safe where you can quickly withdraw from, but earning interest:

- High-yield savings accounts (Ally, Marcus, Capital One)

- Money market funds (like Fidelity SPAXX or Vanguard VMFXX)

- Short-term CDs for a bit more yield if you can lock some funds up

Pro Tip: Use a money market fund through your brokerage to earn 4–5% while still keeping funds accessible. Try to keep checking account balances as low as possible while having enough to meet monthly expenses.

2. 401(k) Employer Match

If your company offers a match—say, 50% on up to 6% of your salary—you should absolutely take it. That’s a guaranteed 50% return, before you even consider market growth.

Pro Tip: Even if you can’t max out your 401(k), contribute at least enough to get the full match. Set it on autopilot so that your paycheck pays directly into it.

3. Pay Down High-Interest Debt

Credit cards or loans with high interest rates quietly kill your financial progress. Paying it down often provides a better return than investing. For example, paying off 18% debt is like earning an 18% return—with zero risk.

Pro Tip: Explore balance transfer cards, consolidation loans, or refinancing. Focus on anything above ~7% first, even before ESPP.

Circle 2: Maximize Financial Tools

At this point, you’re on solid ground and still looking to play it relatively safer. This circle is about using every company benefit or tax-advantaged vehicle available to accelerate long-term growth while still keeping risk fairly low.

4. Employee Stock Purchase Plan (ESPP)

If your company offers an ESPP with a discount (often 10%), you’re getting shares below market price. You can often sell them immediately or after a short holding period for a near-instant gain. When sold shortly after purchase, it’s a low-risk way to capture quick returns. It’s money left on the table if you don’t use it.

Pro Tip: Set a recurring reminder to sell ESPP shares after they vest to avoid overexposure to your company’s stock. Don’t keep too much wealth tied to your employer’s stock.

5. Max Out Your 401(k)

Once your debt is manageable and you’ve claimed the match, consider contributing up to the full limit ($23,000 in 2025 if under 50). It grows tax-deferred, can reduce taxable income, and compounds over decades to help future you to retire comfortably.

Pro Tip: Invest in a target date fund if you want a set-it-and-forget-it approach based on your retirement timeline. If you’re many years away from retirement, you could consider taking more aggressive positions by investing in more equity-based funds.

6. Fully Fund Your HSA

Health costs are one of life’s biggest unknowns. This is a smart way to prepare—and grow your money in the meantime. If you have a high-deductible health plan, you can contribute to an HSA.

HSAs are triple tax-advantaged: no taxes going in, while growing, or coming out (if used for qualified expenses).

Pro Tip: Don’t use your HSA for every little copay. Be sure to invest the funds and let them grow—treat it like a stealth retirement account or for larger healthcare expenses.

7. IRAs (Traditional, Roth, and Backdoor Roth)

Individual Retirement Accounts (IRAs) are powerful tools to grow your retirement savings with tax advantages—and they’re available to nearly everyone, regardless of whether your employer offers a 401(k).

You can contribute up to $7,000 in 2025 (or $8,000 if over 50), and choose the type based on your income and tax strategy:

- Traditional IRA: Contributions may be tax-deductible, and growth is tax-deferred. Great if you expect to be in a lower tax bracket in retirement.

- Roth IRA: Contributions are after-tax, but qualified withdrawals are tax-free. Ideal if you expect to be in a higher tax bracket later.

- Backdoor Roth IRA: If you earn too much to contribute directly to a Roth, you can still get in by contributing to a non-deductible Traditional IRA and then converting it to a Roth.

Pro Tip: If using the backdoor method, keep your Traditional IRA clean of pre-tax money to avoid unnecessary taxes during conversion. Do it early in the year to maximize time in the market. This move gives you tax-free growth and zero required minimum distributions in retirement—more control, more flexibility.

8. Mega Backdoor Roth (if available)

The Mega Backdoor Roth allows high earners to contribute well beyond the standard 401(k) limits using after-tax dollars. It’s only available through certain 401(k) plans, so your first step is confirming if your plan supports it. After you’ve maxed out your pre-tax or Roth 401(k) contributions (up to $23,000 if under 50), you can contribute additional after-tax dollars. If your plan allows, you can then convert those after-tax contributions into a Roth 401(k) or Roth IRA, so the growth becomes tax-free forever.

This strategy is ideal for high earners who’ve already maxed out their regular 401(k), IRA, and HSA contributions and are looking to build significant tax-free retirement income.

Pro Tip: Check with HR or your plan administrator to see if your 401(k) allows both after-tax contributions and in-plan Roth conversions or rollovers to a Roth IRA. If it does, this is one of the most underutilized—and tax-efficient—ways to build wealth.

9. 529 Plans (for Education Savings)

Whether you’re saving for your kids’ college or planning your own learning journey, 529 plans grow tax-free and can be withdrawn tax-free for qualified education expenses. 529 plans grow tax-free and many states offer deductions on contributions.

Pro Tip: You can even use 529 funds for K–12 tuition or roll unused amounts into a Roth IRA (subject to limits) under new rules.

Circle 3: Scale Your Wealth

Now you’re in growth mode. This circle is about freedom—investing in flexible and alternative vehicles to scale your wealth, diversify, and prepare for big life goals.

10. Index Fund Investing in Brokerage Accounts (A Tool You’ll Use Throughout)

A brokerage account isn’t just for when you’ve “made it”—you should have one from the very beginning. It’s your hub for managing and growing money outside of retirement and employer-sponsored accounts.

You can (and should) use your brokerage account to:

- Hold your emergency fund in a high-yield money market fund (like SPAXX or VMFXX).

- Receive and manage ESPP shares and proceeds from ESPP sales.

- Invest excess cash beyond your core monthly reserve—whether for mid-term goals (like a home down payment) or long-term growth.

Brokerage accounts are taxable, but they offer unmatched liquidity and versatility. You should start small and scale over time. The best way to do this is to invest consistently in low-cost ETFs like VOO (S&P 500) or VTI (total U.S. market) that can make a meaningful difference over time. This helps reduce company-specific or even industry-specific risk while helping generate returns.

Pro Tip: Use dollar-cost averaging to invest regularly and reduce the pressure of timing the market.

11. Real Estate, Commodities, and Crypto

Once your core is strong, diversify into other asset classes. Diversification spreads risk and exposes you to growth in different parts of the economy. These assets can provide passive income, hedge against inflation, or offer high-upside growth. These aren’t must-haves, but they’re smart additions once your base is solid. Consider investing in the following asset classes:

- Real Estate: Income and equity through rental properties or REITs

- Commodities: Gold, oil, or agricultural products to hedge inflation

- Crypto: High-risk, high-reward—keep it a small percentage (1–5%)

Pro Tip: Start small—consider REITs instead of buying a property, or limit crypto to 1–5% of your portfolio.

12. High-Growth, High-Risk Investments

This is your experimentation zone. If you’ve covered everything else, a small slice of high-risk investing can be exciting and potentially rewarding—just don’t bet the farm. Options trading, individual stock picks, or margin investing might come into play here. This is the experimental outer ring that can be used to explore and potentially accelerate returns.

Pro Tip: Set strict limits and use separate accounts (like Robinhood) to keep these plays from bleeding into your core strategy.

Final Thoughts: A Framework for Confidence

This strategy isn’t about doing everything at once. It’s about building layer by layer, so your money works harder and your goals stay in focus.

Start where you are. Move outward with intention. Over time, these circles create a financial life that’s secure, flexible, and ready for anything.

Disclaimer: I’m not a financial advisor, and this blog is for informational and educational purposes only. It reflects my personal experience and perspective, not professional financial advice. Please do your own research and consider speaking with a certified financial planner or advisor before making any investment decisions. All investments carry risk, and past performance is not indicative of future results.

Leave a comment